Lifestyle inflation: Its impact on human life.

Lifestyle inflation is a frequent occurrence that happens when people spend more and consume more as their income increases. More financial stability is a common feeling that comes with more income. And people may feel more inclined to upgrade their lifestyle by investing in more opulent goods and indulgent activities. A greater cost of living and more debt may result from this increased spending.

What is inflation?

An economy experiences inflation when the average price of goods and services in that economy consistently rises over time. During inflation, the same amount of money may buy fewer products and services. An inflation rate, which reflects the percentage change in prices over a given period, frequently annually, is typically used to calculate inflation. Numerous things, like rising manufacturing costs, shifting governmental priorities, shifts in currency exchange rates, or an oversized money supply, might contribute to it. In some circumstances, moderate inflation may help an economy by promoting investment and consumption. Governments and central banks frequently employ fiscal programs or change interest rates to control inflation.

Interesting info regarding inflation:

| # A dollar in 1950 was equivalent to $10.23 in 2017. # The annual percentage increase in the cost of products is known as the inflation rate. # “Inflation” is an adaptation of the Latin word “inflare.” # Homes were $3,845.00 on average in 1930. # 1 pound of hamburger meat was usually priced at 12 cents in 1930. # Germany experienced hyperinflation in 1920. # Having a country’s inflation rate increase by 50% in a single month is known as hyperinflation. # Zimbabwe is the first nation in the twenty-first century to face hyperinflation, In 2008. |

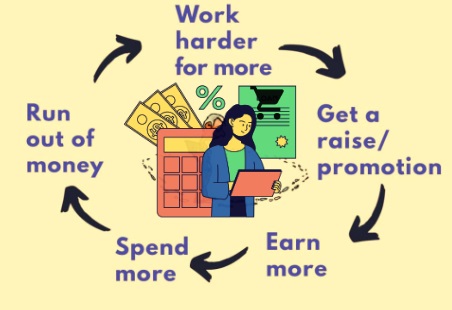

Causes of lifestyle inflation?

Increased income, whether from a new job, a pay raise, or a substantial inheritance, is the main driver of lifestyle inflation. People frequently start to spend more when their income increases, which raises the cost of living. Other variables that contribute to lifestyle inflation include peer pressure to maintain a higher quality of living than one’s own and a mentality change that justifies spending more since one has more money.

Disadvantages of lifestyle inflation?

Lifestyle inflation has a number of drawbacks that people should be aware of. It can prevent you from saving money. People sometimes disregard saving for emergencies, retirement, or other long-term financial goals as they raise their expenditures to keep up with or exceed their expanding income. People who don’t save money may be more vulnerable to unforeseen expenses or find it more challenging to achieve financial security in the future. Inflation in lifestyle costs can also contribute to rising debt. People may find themselves amassing debt. That is challenging to manage and repay due to increased expenditure and possibly relying on credit. Future financial opportunities and financial security may be negatively impacted by this debt load.

Example of lifestyle inflation?

Imagine a person named Mrs. Y who starts her career with an entry-level job and a modest income. She lives in a small apartment, cooks meals at home, and shops for affordable clothing. As Mrs. Y’s career progresses, she receives promotions and salary increases. With the higher income, she decides to move to a larger apartment in a more upscale neighborhood. She starts dining out more frequently, treating herself to expensive meals. She also starts buying designer clothing and accessories, taking expensive vacations, and indulging in luxurious experiences. Y’s increased income has led her to upgrade her lifestyle significantly, spending more on housing, leisure, and material possessions, all in line with her higher income level. This is an example of lifestyle inflation, where Y’s spending and consumption habits have risen in response to her increased earnings.

How can we avoid Lifestyle Inflation?

Prioritizing financial goals and practicing mindful spending is essential to avoiding the trap of lifestyle inflation. First off, keeping a budget and keeping track of expenses can help you spot wasteful spending and reroute money to savings and investing. Clarifying your financial objectives, such as setting aside money for retirement, unexpected expenses, or particular milestones, can give you a sense of direction and help you control your spending. Furthermore, it’s critical to reject peer pressure and comparison temptation in favor of concentrating on one’s own values and long-term interests. One can reduce wasteful spending by periodically evaluating one’s requirements vs wants and differentiating between necessary and discretionary expenses. Last but not least, developing a thrifty mindset and placing more emphasis on experiences than on things can deliver lasting happiness while halting lifestyle inflation.

How technology can help to overcome inflation?

By increasing productivity, and efficiency, and encouraging economic growth, technology can significantly contribute to reducing inflation. Technological progress can boost production capacity, reduce costs, and improve supply chain management. By enabling the production of more goods and services at a reduced cost, this may help to lessen the pressures brought on by inflation. Technology may also automate operations, which decreases the demand for labor-intensive jobs and boosts productivity in general. Because of the potential for increasing output without an equal rise in cost, this enhanced productivity can help keep prices steady. Technology can also encourage innovation and the emergence of new industries, opening doors for economic diversity and expansion. Additionally, it can foster competition, increase market transparency, and make resource allocation more effective. Technology can aid in lowering inflationary pressures and establishing a more stable and prosperous economic climate by enhancing productivity, efficiency, and creativity.

for more updates, visit:

https://toptecviews.com/education/lifestyle-inflation-its-impact-on-human-life/

Comments

Post a Comment